According to the most recent analysis conducted by the shipping consultancy Linerlytica, the market panic caused by the decreasing availability of vessel space has caused the Shanghai Containerized Freight Index (SCFI) to reach its highest level since September 2022. The index increased by 18.8% after the holiday break that occurred last week, reaching a level that was not seen in twenty months.

In contrast to the spike that occurred in January, when the rate rises were primarily restricted to the routes that were hit by the Red Sea, the gains that have occurred this time are more widespread, with sharp rate hikes being implemented on all long-haul routes as a result of a strong comeback in demand in advance of the summer peak season.

According to Linerlytica, carriers are spreading the fear by saying that capacity loss on the Asia-Europe and Med routes has reached 15-20%. Maersk is one of the carriers that has raised the alarm.

“Although the effective capacity situation is not as dire as the carrier suggests, the strong demand has taken the market by surprise with box equipment and vessels also in short supply,” according to Linerlytica.

In just the month of April, the production of new dry boxes reached a staggering 520,000 TEUs, which is three times greater than the monthly average for 2023. Furthermore, the new plant output is fully booked until the end of July.

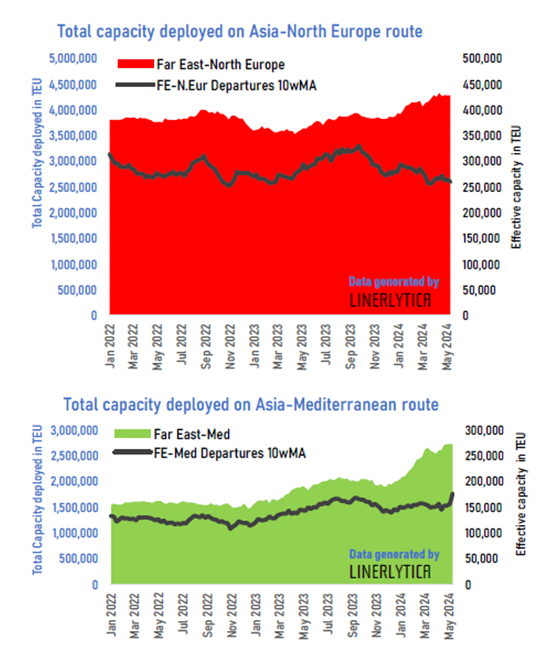

Increases in capacity to the Mediterranean region compensate for the loss of capacity to Asia and North Europe

According to the report by Linerlytica, effective capacity to North Europe based on actual vessel departures from Asia has decreased by 5.1% compared to a year ago. This occurred as a result of the longer route taken by the majority of vessels via the Cape of Good Hope. This occurred despite the deployment of 17.8% more vessel capacity on the Asia-North Europe route.

The Asia-Med route, on the other hand, has seen an increase in effective capacity of 10.5% despite the Cape diversions. This is due to the fact that the overall capacity deployed on this route has increased by 49.1% in comparison to the previous year.

Despite the fact that Maersk asserts that the industry as a whole is experiencing a capacity loss of 15% to 20% on the Asia-Europe/Med routes, the aggregate capacity is 0.3% higher in effective terms compared to the previous year. This is due to the fact that the total vessel capacity deployed on the two routes has increased by 28%, going from 5.45 million TEUs to close to 7 million TEUs at the present position.

Furthermore, as a result of the Cape diversions, an additional capacity of 1.2 million TEUs has been added in only the past five months alone. As a result of the fact that freight rates to the Mediterranean have enjoyed a 30–50% premium over those to North Europe, the majority of the incremental capacity, which amounts to 800,000 TEUs, has been allocated to the Mediterranean. However, the gap has shrunk in recent times.